Open Account

High Yield Checking0.01%-4.00% APY1 |

| A free, high yield checking account. |

| ATM fee refunds up to $15.¹ |

| No minimum balance. |

| Open Now |

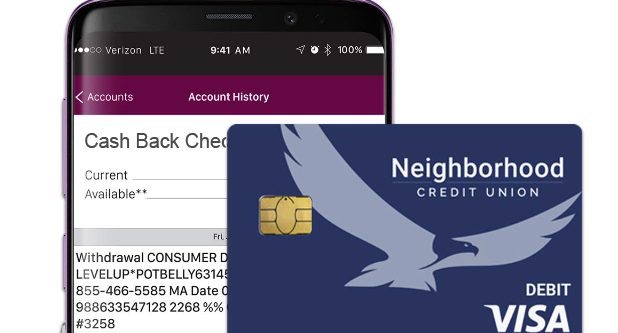

Cash Back CheckingCash Back Rewards² |

| A free, cash back rewards checking account. |

| ATM fee refunds up to $15.2 |

| No minimum balance. |

| Open Now |

Priority CheckingOverdraft Fee Forgiveness†Learn More

|

| Overdraft fee forgiveness† & low opening deposit checking account. |

| No minimum balance. |

| Reduce or eliminate your monthly fee.3 |

| Open Now |

Fresh Start Checking |

| A checking account to help you get back on your feet. |

| $20 monthly service fee. |

| Eligible to convert to another checking account after 6 months. |

Student Accounts |

| Ages 13 - 17 |

| Free checking and savings accounts |

| Parent or guardian must be co-owner to open account |

| Open Now |

1High-Yield Checking qualifications that must be met to obtain the Higher Interest Rate and ATM Withdrawal and Inquiry Fee refunds include: 1. Fifteen (15) individual or combined debit card or credit card transactions of at least $5.00 or more each (transactions may take more than one day to post/settle to your account); AND 2. Have an aggregate of ACH direct deposits totaling $500 or more post and settle each qualifying cycle; AND 3. Sign up and agree to receive eStatements and decline paper statements. ATM transactions or transfers between accounts not valid for qualifying. Qualifying transactions must post to and settle account during monthly qualification cycle Qualification Cycle and Statement Cycle = the first day of the month through the last day of the month. If qualifications are met each monthly qualification cycle: (a) Domestic ATM withdrawal and inquiry fees incurred during qualification cycle will be reimbursed up to an aggregate of $15 and credited to account on the last day of monthly statement cycle; (b) balances up to $50,000 receive APY of 4.00%; and (c) balances over $50,000 earn 0.10% APY on portion of balance over $50,000, resulting in 4.00% to 1.40% APY depending on the balance. If qualifications are not met, all balances earn 0.01% APY. Minimum to open is $100. Account is free from a monthly service fee, other fees may apply. Fees may reduce earnings (see fee schedule). Limit one account per household. Federally Insured by NCUA.

2Cash Back Checking qualifications that must be met to obtain cash back rewards and ATM Withdrawal and Inquiry Fee refunds include: 1. Fifteen (15) individual or combined debit card or credit card transactions of at least $5.00 or more each (transactions may take more than one day to post/settle to your account); AND 2. Have an aggregate of ACH direct deposits totaling $500 or more post and settle each qualifying cycle; AND 3. Sign up and agree to receive eStatements and decline paper statements. ATM transactions or transfers between accounts not valid for qualifying. Qualifying transactions must post to and settle account during monthly qualification cycle. Qualification Cycle and Statement cycle = first day of month through last day of month. If qualifications are met each monthly qualification cycle: (a) Domestic ATM withdrawal and inquiry fees incurred during qualification cycle will be reimbursed up to an aggregate of $15 and credited to account on the last day of monthly statement cycle; and (b) you will receive 3% cash back on purchases up to $200 for a total of $6 per month on combined debit and credit card purchases. If qualifications are not met, no cash back payments are made and ATM withdrawal fees are not refunded. Minimum to open is $25. Account is free from a monthly service fee, other fees may apply. Fees may reduce earnings (see fee schedule). Limit one account per household. Federally Insured by NCUA.

3Restrictions apply. Priority Checking begins with a $11.99 base service charge monthly fee that can be reduced or eliminated. The fee is reduced by $1.00 each Monthly Qualification Cycle for receiving electronic statements. The fee is reduced by $.20 each time you use your debit card to make a signature-based purchase during the Monthly Qualification Cycle (purchase must be $5 or more; ATM and PIN based transactions are excluded). Qualification Cycle and Statement Cycle = the first day of the month through the last day of the month. Transactions may take one or more banking days from the date the transaction was made to post to and settle account. See the Fee Schedule here. **Overdraft Fee Forgiveness applies only to fees charged for overdraft and Courtesy Pay and is granted upon request on an annual basis. Relationship Fee refunds received during the calendar year will count toward the annual limit of $40.

†Overdraft Fee Forgiveness applies only to fees charged for overdraft and Courtesy Pay and is granted upon request on an annual basis.

View the Truth-in-Savings Disclosures and Notice Documents.

Prize Savings0.10% APY1 |

| Minimum Deposit: $25 |

| Win cash just for saving your money. |

High Yield Savings3.00% APY2 |

| Minimum Deposit: $10,000 |

| 24/7 access to funds and no maintenance fees. |

Certificates of Deposit3.50%-5.00 % APY3 |

| Minimum Deposit: from $500 |

| Multiple terms and rates available for low-risk investment. |

Individual Retirement (IRA)0.10% APY3 |

| Minimum Deposit: $100 |

| Save for retirement with a Traditional IRA or Roth IRA. |

Christmas Club0.10% APY4 |

| Minimum Deposit: $100 |

| Withdrawals not allowed until November for holiday spending. |

Kids Savings0.10% APY5 |

| Minimum Deposit: $25 |

| For kids ages 0 - 12 years old. |

Special Savings0.10% APY* |

| Minimum Deposit: $25 |

| For teens or to use as a secondary savings account. |

Minor Accounts |

| Ages 13 - 17 |

| Free checking and savings accounts |

| Parent or guardian must be co-owner to open account |

| Open Now |

Visa Signature® Cash Rewards1.50% cash back on all purchases5 |

| Earn 1.50% cash back on all of your purchases.5 |

| No annual fee. |

| Low variable interest rate from 16.50% and that will never go above 18.00%.5 |

Visa PlatinumIntro Rate of 1.99% APR‡ |

| No annual fee. |

| Auto Rental Collision Damage Coverage |

| Introductory APR for up to 6 months, then variable APR is based on your creditworthiness from 13.50% up to 18.00%‡ |

5Must be 18 years or older to apply. Applicants under the age of 21 may require a co-signer unless independent means of repayment can be established. Minimum credit line is $5,000. APR based on creditworthiness. Rates are variable and subject to change and will be calculated based on the Wall Street Journal Prime Rate and may go up to a maximum of 18.00%. Minimum payment is 3% of total new balance or $35.00, whichever is greater. Cash advance fee is $10 or 3.00% of the amount of each cash advance, whichever is greater. Late and returned payment fee: up to $35. A Foreign Transaction fee of 2.00% will be applied in US Dollars to each transaction conducted outside of the United States. No balance transfer fees. Additional limitations, terms and conditions may apply. Equal Opportunity Lender. Read the Visa Rewards Credit Card Disclosure. View the Rewards Guide to Benefits.

‡Must be 18 years or older to apply. Applicants under the age of 21 may require a co-signer unless independent means of repayment can be established. Introductory APR only applicable to new credit card applications. 1.99% Introductory APR for 6 months from issuance of the card on balance transfers and purchases. After the introductory period, APR will be adjusted based on creditworthiness and balance transfer fee will be at 3%. Rates are variable and subject to change and will be calculated based on the Wall Street Journal Prime Rate and may go up to a maximum of 18.00%. Minimum payment is 3% of total new balance or $35.00, whichever is greater. Cash advance fee is $10 or 3.00% of the amount of each cash advance, whichever is greater. Late and returned payment fee: up to $35. A Foreign Transaction fee of 2.00% will be applied in US Dollars to each transaction conducted outside of the United States. Additional limitations, terms and conditions may apply. Equal Opportunity Lender. View the Platinum Credit Card Disclosure and the Guide to Benefits.

Inflate My Rate CD |

| A short-term certificate of deposit that allows one opportunity during the term to request your rate be matched to the 18-month CD rate.¹ Already a member? Open Your CD Here |

| Fixed Interest Rate: 4.40% |

| Minimum Opening Deposit: $2,500 |

| Term: 25 Months |

| Rate Match: One rate match to our Standard 18-Month CD rate allowed during 25-month term. How do I request my rate match? |

| Good to Know: No additional deposits allowed. After 25-months, this CD converts and renews as a Standard 18-Month CD. |

|

|

Online Savings |

|

An exclusive rate only available online with additional deposits allowed.

Already a member? Open Your CD Here

|

| Fixed Interest Rate: 4.12% |

| Minimum Opening Deposit: $1,500 |

| Term: 17 Months |

| Good to Know: Must be 18 years of age or older. |

|

|

FlexPlus |

|

A short-term length option with a low opening deposit and additional deposits allowed.

Already a member? Open Your CD Here

|

| Fixed Interest Rate: 3.92% |

| Minimum Opening Deposit: $500 |

| Term: 12 Months |

|

|

1Rates effective March 1, 2024. Inflate My Rate CD: APY = Annual Percentage Yield. Must be 18 years of age or older to open Certificate of Deposit. Rates subject to change. Interest is compounded daily. $2,500 minimum deposit to open. Only one rate increase allowed during 25 month term. Rate increase is not automatic and is dependent on member request by secure communication or verifiable documents. Rate increase will have an effective date that begins on date of confirmed request and will be in effect from that date till term end. Rate increased interest rate is dependent on Neighborhood CU's 18 month CD. If our 18 month CD rate increases during your Inflate My Rate CD's 25 month term, request a rate increase and we'll increase your Inflate My Rate CD's interest rate to match the 18 month CD rate. The new rate is locked in until end of the term. At the end of the 25 month term, Inflate My Rate CD converts and renews as a standard Neighborhood CU 18 month CD. Cannot be combined with any other rate offers or rate increase promotions. Not offered on trusts, business accounts or Individual Retirement Accounts (IRAs). An interest penalty is required for early withdrawal. Fees may reduce earnings. Federally insured by NCUA.

Get paid up to 2 days early.*

Get paid up to 2 days early.*

*Neighborhood Credit Union may give early access to direct deposit funds from your employer, payments and credits into your account, or government deposits and payments depending on when the deposit or payment file is submitted to Neighborhood CU. Weekends or bank holidays may affect the posting date. As a result, the availability or timing of early direct deposit may vary from pay period to pay period. Fraud prevention restrictions may apply and delay early availability of funds. Early availability is not guaranteed. Additional restrictions may apply.

| Simply meet one of the below criteria OR be related to someone who does: | |

| Live or work in: |

Dallas County

Ellis County Denton County

Collin County

Tarrant County

City of Arlington |

| Live, work, worship, or attend school within a 10 mile radius of the branches in: | Coppell Grand Prairie Highland Village |

| Currently employed or retired from: | A Company Served by Neighborhood Credit Union Dallas United States Postal Service Arlington United States Postal Service |

| Become a member of the Neighborhood Credit Union Foundation, which is automatically done for you upon approval, and live in: | Texas |

| A member or potential member of the American Consumer Council and reside in one of the following counties: | Delta Denton Hunt Johnson Kaufman Parker Rockwall Tarrant Wise |

All Neighborhood Credit Union accounts feature:

Surcharge-Free ATMs

Courtesy Pay

Refer Friends For Rewards

Mobile Wallet

Send Money with Zelle®

GreenPath Financial Wellness

Why Join a Credit Union

Why Neighborhood Credit Union is a great choice for checking, savings, and loans.

With over 90 years of experience, Neighborhood Credit Union knows how to help people reach their financial goals.

We now have several branches across the DFW Metroplex. We proudly provide our members with customized savings accounts and competitive rates.

As a not-for-profit, we pass savings on to you through greater returns. We also invest in technology to offer a top-of-the-class online and mobile banking experience. You can manage your accounts easily through online banking or our mobile app for iOS or Android.

At Neighborhood Credit Union, we’re committed to guiding you every step of the way toward financial security.