.webp)

Cash Back Checking

No-Fee Checking with Cash Back Rewards

Earn 3% cash back on purchases for a maximum of $6 each month and ATM fee refunds¹

To Qualify for Rewards

- Fifteen (15) individual or combined debit or credit card transactions of $5.00 or more post or settle

- Does not include RelyOn CU Credit Cards

- AND ACH direct deposits that total $500 or more

- AND go paperless! Sign up to receive eStatements and decline paper statements

Cash Back Checking Account Benefits

- Free checking with no minimum balance required

- Free debit card that earns MyPoints

- Get your direct deposit up to 2 days early*

- Courtesy Pay‡

- Opening deposit minimum: $25

- Online and mobile banking

- Upgrade your debit card to My Rewards Gold or Platinum.

My Rewards Debit Cards

Join our exclusive members-only rewards program! Earn points every time you shop with your My Rewards® Gold or Platinum Debit Cards. Spend $100 using your eligible Neighborhood Credit Union Visa Debit Card and accumulate points redeemable for fantastic prizes!³

*Additional Fees may apply, view our Rates and Fees for full details.

†Qualification Cycle = the first day of the month through the last day of the month.

¹Cash Back Checking qualifications that must be met to obtain cash back rewards and ATM Withdrawal and Inquiry Fee refunds include: 1. Fifteen (15) individual or combined debit card or credit card transactions of at least $5.00 or more each (transactions may take more than one day to post/settle to your account); AND 2. Have an aggregate of ACH direct deposits totaling $500 or more post and settle each qualifying cycle; AND 3. Sign up and agree to receive eStatements and decline paper statements. ATM transactions or transfers between accounts not valid for qualifying. Qualifying transactions must post to and settle account during monthly qualification cycle. Qualification Cycle and Statement cycle = first day of month through last day of month. If qualifications are met each monthly qualification cycle: (a) Domestic ATM withdrawal and inquiry fees incurred during qualification cycle will be reimbursed up to an aggregate of $15 and credited to account on the last day of monthly statement cycle; and (b) you will receive 3% cash back on purchases up to $200 for a total of $6 per month on combined debit and credit card purchases. If qualifications are not met, no cash back payments are made and ATM withdrawal fees are not refunded. Minimum to open is $25. Account is free from a monthly service fee, other fees may apply. Fees may reduce earnings (see fee schedule). Limit one account per household. Federally Insured by NCUA.

‡Courtesy Pay is available to qualified members after 2 days and overdraft fees apply. See Rates & Fees page for current fees. Please view the Courtesy Pay Guide here.

View the Truth-In-Savings Disclosure(Opens in a new Window).

Why Choose Cash Back Checking?

No-Fee Checking Account

Earn 3% Cash Back¹

ATM Fee Refunds¹

No Minimum Balance

Upgrade to My Rewards® Premium Debit Cards

Upgrade to My Rewards® Premium Debit Cards

Join our exclusive members-only MyPoints Rewards program! Earn up to 3x more points every time you swipe your My Rewards® Gold or Platinum Debit Cards. Get rewarded for everyday purchases and accumulate points redeemable for prizes, trips, and gift cards!

|

It's a fast, secure, and straightforward method to send and request money. Whether you're splitting bills with friends or reimbursing family for shared expenses, Zelle offers a convenient solution so you can skip the hassle of visiting an ATM or dealing with cash.

|

Get paid up to 2 days early.**

Get paid up to 2 days early.**

**Neighborhood CU may give early access to direct deposit funds from your employer, payments and credits into your account, or government deposits and payments depending on when the deposit or payment file is submitted to Neighborhood CU. Weekends or bank holidays may affect the posting date. As a result, the availability or timing of early direct deposit may vary from pay period to pay period. Fraud prevention restrictions may apply and delay early availability of funds. Early availability is not guaranteed. Additional restrictions may apply.

All Neighborhood Credit Union checking accounts feature:

Set Up Direct Deposit

Surcharge-Free ATMs

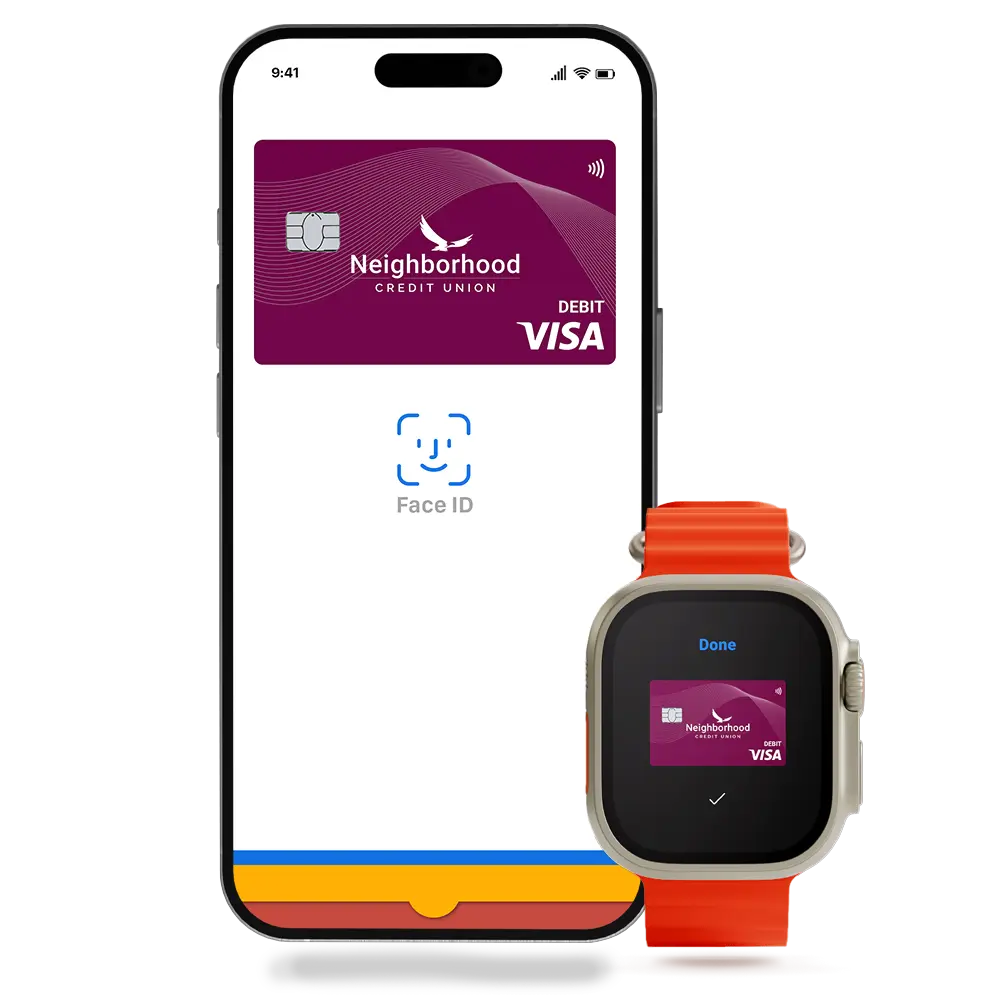

Mobile Wallet

Send Money with Zelle®

GreenPath Financial Wellness

Want to compare our accounts side by side?

| Account Type | Summary | ATM Refunds² | High Yield Interest APY¹ | Opening Deposit | Monthly Fee |

|---|---|---|---|---|---|

| High Yield |

Free checking with high-yield interest.

|

Yes | 0.01% - 5.00% | $100 | $0 |

| Cash Back |

Free checking with cash back rewards.

|

Yes | No | $25 | $0 |

| Priority |

Low Opening Deposit and Overdraft Fee Forgiveness.

|

No | No | $25 | $11.99 |

| Fresh Start |

Ideal for those with less-than-perfect checking needing to get back on their feet.

|

No | No | $25 | $20 |

| Minor/Student Accounts |

Frequently Asked Questions

- visit our online portal to open a checking or savings account

- apply for a loan online

- make an appointment to visit one of our branches,

- and by phone.

Complete the following requirements each Qualification Cycle† to qualify for rewards for your High Yield or Cash Back checking account:

- Fifteen (15) individual or combined debit or credit card transactions of $5.00 or more post or settle

- AND ACH direct deposits that total $500 post and settle

- AND go paperless! Sign up to receive eStatements and decline paper statements

Why Neighborhood Credit Union is a great choice for checking, savings, and loans.

With over 90 years of experience, Neighborhood Credit Union knows how to help people reach their financial goals.

We now have several branches across the DFW Metroplex. We proudly provide our members with customized savings accounts and competitive rates.

As a not-for-profit, we pass savings on to you through greater returns. We also invest in technology to offer a top-of-the-class online and mobile banking experience. You can manage your accounts easily through online banking or our mobile app for iOS or Android.

At Neighborhood Credit Union, we’re committed to guiding you every step of the way toward financial security.