Neighborhood Credit Union

Start Your Journey to Financial Success

Why We’re Different

We’re here not to make a profit, but to empower our member’s financial success and reward them for every day banking. Through awarding high yield interest on a free checking account, giving away money just every week for good savings habits, college scholarships, and financial education, we’re in the business of helping people achieve their goals and live a life of financial freedom.

High Yield Checking0.01%-5.00% APY1 |

| A free, interest-earning checking account. |

| ATM withdrawal fee refunds.2 |

| No minimum balance. |

| Open Now |

Auto LoansLearn More

|

| Apply online and make no payments for 90 days.† |

| Loans for new, used, refinancing, and recreational vehicles. |

| GAP, Dent Guard, and Extended Warranty insurance available. |

| Apply Now |

High Yield Savings Account2.75% APY4 |

| Minimum Deposit: $10,000 |

| 24/7 access to funds and no maintenance fees. |

Cash Rewards Credit Card1.50% cash back on all purchases5 |

| Earn 1.50% cash back on all of your purchases.5 |

| No annual fee or balance transfer fees. |

| Low variable interest rate.5 |

1APY = Annual Percentage Yield. High-Yield Checking qualifications that must be met to obtain the Higher Interest Rate and ATM Withdrawal and Inquiry Fee refunds include: 1. Fifteen (15) individual or combined debit card or credit card transactions of at least $5.00 or more each (transactions may take more than one day to post/settle to your account); AND 2. Have an aggregate of ACH direct deposits totaling $500 or more post and settle each qualifying cycle; AND 3. Sign up and agree to receive eStatements and decline paper statements. ATM transactions or transfers between accounts not valid for qualifying. Qualifying transactions must post to and settle account during monthly qualification cycle Qualification Cycle and Statement Cycle = the first day of the month through the last day of the month. If qualifications are met each monthly qualification cycle: (a) Domestic ATM withdrawal and inquiry fees incurred during qualification cycle will be reimbursed up to an aggregate of $15 and credited to account on the last day of monthly statement cycle; (b) balances up to $25,000 receive APY of 5.00%; and (c) balances over $25,000 earn 0.10% APY on portion of balance over $25,000, resulting in 5.00% to 1.08% APY depending on the balance. If qualifications are not met, all balances earn 0.01% APY. Minimum to open is $100. Account is free from a monthly service fee, other fees may apply. Fees may reduce earnings (see fee schedule). Limit one account per household. Federally Insured by NCUA.

2ATM Withdrawal Fees: If qualifications are met each monthly qualification cycle domestic ATM withdrawal fees incurred during qualification cycle will be reimbursed up to an aggregate of $15 and credited to account on the last day of monthly statement cycle.

³APR = annual percentage rate. †Must be 18 years or older. Credit qualifications and application required. Rates subject to change. To be eligible for up to 120 Days No Payments applicant must have a credit score of 700 or above. Up to 120 days no payments based on credit qualification. Interest begins accruing the day the loan is funded. Offer valid for a limited time only. Does not apply to vehicles currently financed through Neighborhood Credit Union.

All Neighborhood Credit Union deposit accounts feature:

Surcharge-Free ATMs

Courtesy Pay

Set Up Direct Deposit

Want to compare our checking accounts side by side?

| Account Type | Summary | ATM Refunds² | High Yield Interest APY¹ | Opening Deposit | Monthly Fee |

|---|---|---|---|---|---|

| High Yield |

Free checking with high-yield interest.

|

Yes | 0.01% - 5.00% | $100 | $0 |

| Cash Back |

Free checking with cash back rewards.

|

Yes | No | $25 | $0 |

| Priority |

Low Opening Deposit and Overdraft Fee Forgiveness.

|

No | No | $25 | $11.99 |

| Fresh Start |

Ideal for those with less-than-perfect checking needing to get back on their feet.

|

No | No | $25 | $20 |

| Minor/Student Accounts |

Account Finder

Frequently Asked Questions

Why Neighborhood Credit Union is a great choice for checking, savings, and loans.

With over 90 years of experience, Neighborhood Credit Union knows how to help people reach their financial goals.

We now have several branches across the DFW Metroplex. We proudly provide our members with customized savings accounts and competitive rates.

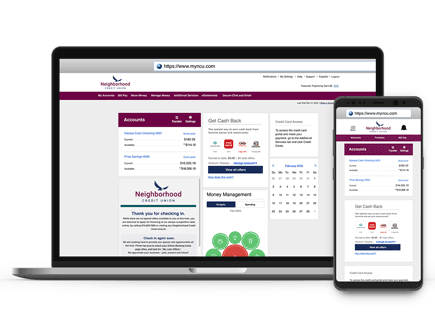

As a not-for-profit, we pass savings on to you through greater returns. We also invest in technology to offer a top-of-the-class online and mobile banking experience. You can manage your accounts easily through online banking or our mobile app for iOS or Android.

At Neighborhood Credit Union, we’re committed to guiding you every step of the way toward financial security.