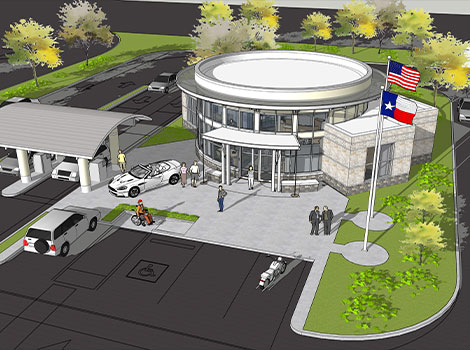

Neighborhood Credit Union in Sherman, TX

Local Banking That Puts Members First

A $250 Thank-You When You Open a Checking Account¹Earn high-yield interest or cash back for the things you do anyway.

|

| Choose between our no fee checking accounts and earn up to 5.00% APY* with High Yield Checking or 3% cash back (up to $6)** with Cash Back Checking. |

|

Get ATM fee refunds up to $15 and no minimum balance required.‡

|

| Promo Code: SHERMAN |

| Good to Know: Enjoy perks like getting paid up to 2 days early and the MyNCU Mobile App. You can even upgrade your free Visa® debit card to the MyRewards Gold or Platinum cards. |

|

|

Get 1.00% Off Your Qualified Auto Loan Rate²New, used, or refinance - let us make your next car loan easy with the best auto loans in Texas!

|

| Rates start at 3.99% APR and enjoy up to 120 days of no payments.² |

| Get pre-approved with our MVP Check program! |

| Promo Code: SHERMAN |

|

|

Growth at a Glance

95 years

69,000 members

$1 billion+

$22 million

Support Sherman, Bank Local

Profit is returned to you with better rates & lower fees.

We are not-for-profit, owned & governed by the members.

Local decisions. Real people.

Why Sherman?

At Neighborhood Credit Union, we’re committed to delivering exceptional financial solutions designed around the people we serve. As a local credit union expanding into Sherman, Texas, we’re excited to grow alongside a community full of opportunity and momentum.

Sherman is in the midst of an exciting transformation, attracting major investment and new jobs that are shaping the future of North Texas. With significant development and thousands of new careers coming to the area, the need for a trusted credit union in Sherman, TX has never been greater — one that understands local needs and puts members first.

That’s where we come in. From everyday checking accounts and savings to auto loans, home loans, and personalized financial guidance, we’re here to support individuals and families at every stage of life. Whether you’re opening your first bank account, financing a vehicle, buying a home, or planning for the future, our team is ready to help you move forward with confidence.

As a local credit union, we believe banking should feel personal, accessible, and rooted in the community. We’re proud to invest in Sherman’s growth and even prouder to support the people who make it thrive.

Become a member and experience the credit union difference with a financial partner dedicated to your success. We look forward to serving Sherman and being part of its bright future.

Our Story

Originally known as Dallas Postal Credit Union, Neighborhood Credit Union opened its doors to its first members in April 1930, just months after the U.S. stock market crashed. During the Great Depression, when American confidence in financial institutions was at an all-time low, Dallas Postal Credit Union won the trust and loyalty of its charter members. In 2001, the credit union officially changed its name to Neighborhood Credit Union, a name that more accurately reflects the diverse base of members from all over the Dallas area.

Sherman Branch Construction Timeline

August 2023

October 2023

November 2023

November 2, 2023

January 2024

February 2024

April 2024

.jpg)

June 2024

August 2024

September 2024

Neighborhood News and Events

Become a Member Today