Auto Loans as low as 3.99% APR*

Plus, up to 90 days with no payments to help you get on the road sooner.

Make More with 5.00% APY Checking*

Put your money to work - earn 5.00% APY on balances up to $25,000 with High Yield Checking.

Neighborhood CU in the Community

See how we’re making an impact in the communities we serve through testimonials, photos, and real numbers.

Community Page

.webp)

Avoiding Gift Card Scams

Learn about the emerging threat of gift card scams this holiday season in the North Texas Capital Advisors blog.

Smart Saving. Big Reward.

Congratulations to Leticia, our $49,999.99 Grand Prize Winner of 2025. Her commitment to saving as a longtime member truly paid off.

Better Rates than Banks

★★★★★

"I’ve banked with multiple credit unions, but Neighborhood Credit Union stands out above the rest! Their customer service is outstanding, and their products and rates are unbeatable. Every experience has been positive, and their employees always go above and beyond to help. Highly recommend!"

-Deyanira V.

Featured Favorites

Get started on your journey to financial wellness.

What's Happening in the Neighborhood?

02/11/2026

Carolyn Jordan Nominated for African-American Credit Union Coalition 2026 Hall of Fame

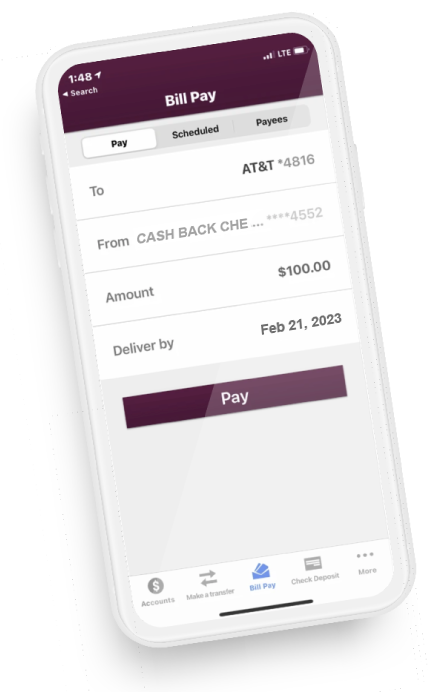

Bank from anywhere.

We make sure that you can bank safely and securely from where ever you are. Use our award-winning app to manage your accounts, deposit checks, make transfers, and more.

>

Take Control of Your Money

Build smarter financial habits with our Money Management Guide. Learn how to budget, track spending, set savings goals, and take charge of your financial future, all in one easy-to-follow resource.

Inflate My Rate CD

The short-term certificate of deposit that earns you high interest and a one-time rate match bump to our 18-month Standard CD.*

Frequently Asked Questions

Joining a credit union is easier than you think! There are several ways you're able to become a member, and you even qualify simply if you have a family member that does.

You're eligible if you live in the state of Texas!

You don't give up anything when you switch from a big bank, either. We offer several online & mobile services(Opens in a new Window)(Opens in a new Window) and convenience services(Opens in a new Window)(Opens in a new Window), including online banking, the MyNCU Mobile App for iOS and Android, mobile check deposit, courtesy pay, and more. Not only are we a fully digital credit union, but we have several locations in the DFW Metroplex(Opens in a new Window)(Opens in a new Window).

Credit unions are not-for-profit and governed by the members, so this means that company earnings are returned to you as a member in the form of high interest rates on deposit accounts, low rates on loans, and lower fees. $17 million in interest dividends were paid back to our members in 2024 alone.

We offer several online & mobile services and convenience services, including online banking, the MyNCU Mobile App for iOS and Android, mobile check deposit, courtesy pay, ITMs and more. We also have several locations in the DFW Metroplex.

We're excited you'd love to be a part of our team! Visit our careers page for more information and open positions.

.webp)