New User Experience for Neighborhood CU Credit Card Portal

Published January 25, 2022

A new year calls for a refresh! Starting January 26, 2022, you may notice a brand-new user experience in the Neighborhood Credit Union credit card portal!

With this new credit card portal update, no action is required of our credit card holders. This includes automated and scheduled payments, which will not be affected. Please note that there may be a temporary downtime of about an hour during the early morning of January 26 as the update takes place.

We’re excited to announce that the new portal will be mobile-friendly as well! An update to access the credit card portal in the MyNCU Mobile app will be made available later this year.

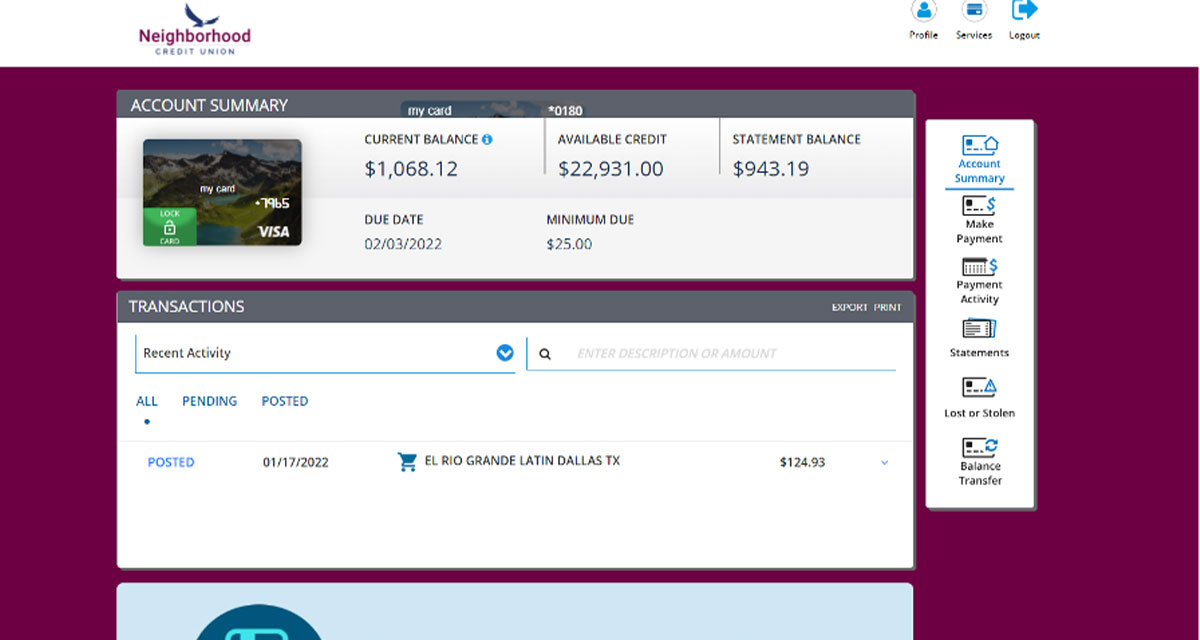

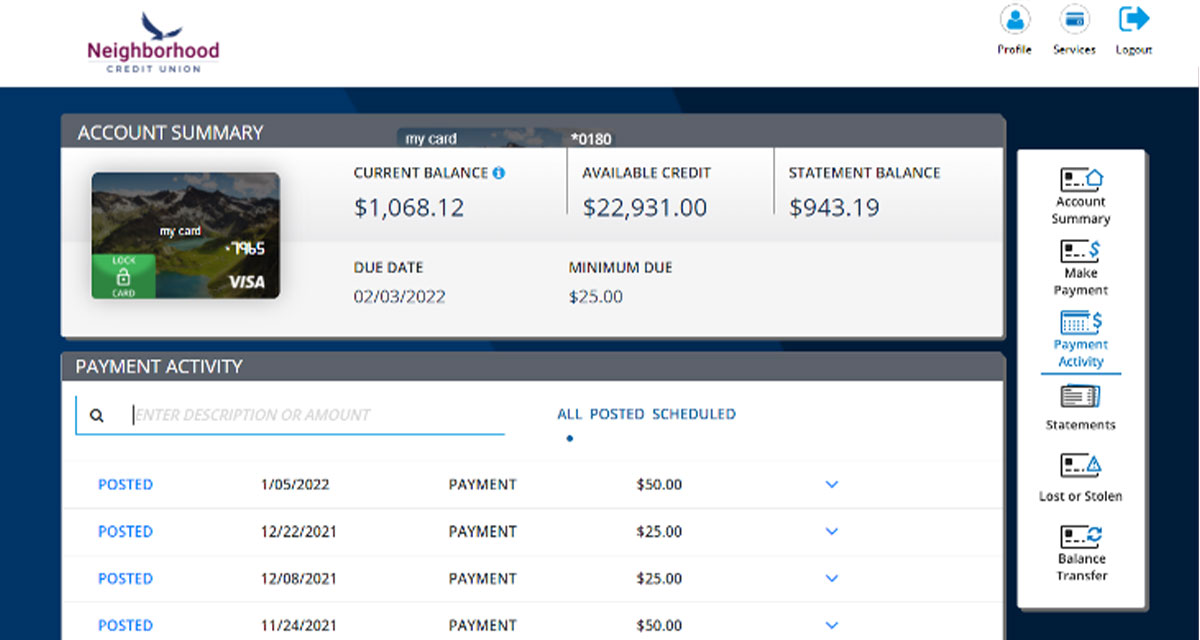

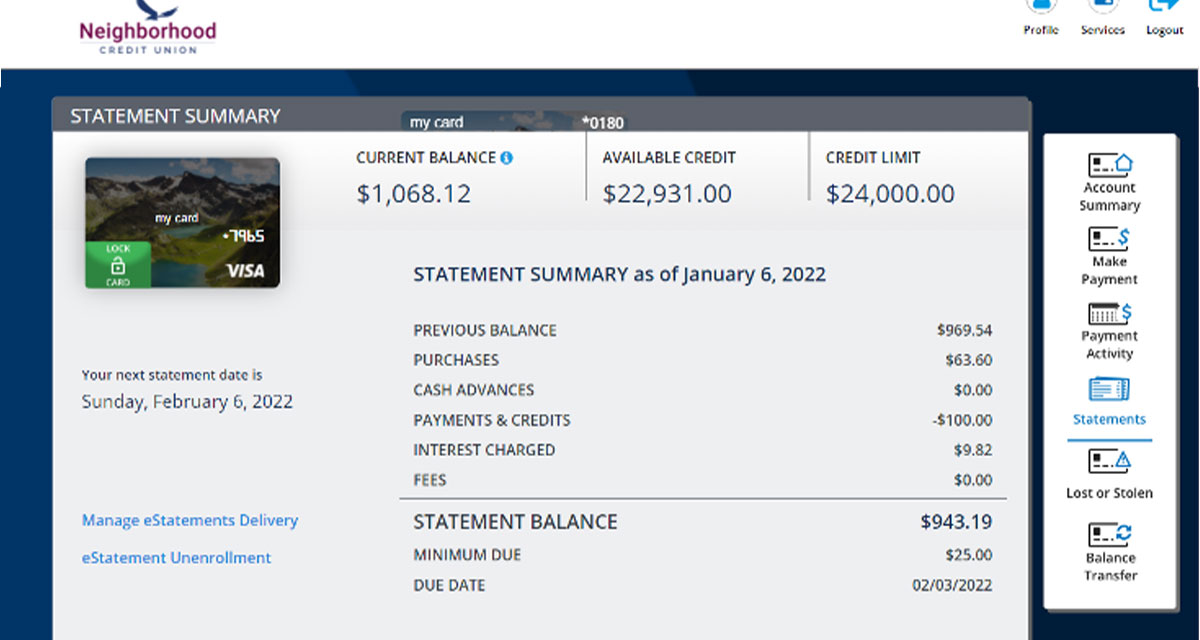

A Sneak Peak at the New Credit Card Portal

Account Summary Homepage

Payments Page

Statements Page

Credit Cards at Neighborhood Credit Union

We offer two different credit cards both equally loaded with perks: Platinum Credit Card and Cash Rewards Credit Card.

Get 0.0% APR for 6 months on a Visa® Platinum credit card, enjoy no annual fee, no balance transfer fee, and a variable interest rate of 10.00-18.00% APR* after the promotional 6 months.1

Get 0.0% APR for 6 months on a Visa® Platinum credit card, enjoy no annual fee, no balance transfer fee, and a variable interest rate of 10.00-18.00% APR* after the promotional 6 months.1

Our Visa Signature Cash Rewards credit card has 1.50% cash back on all purchases, with no cash back limit, no annual fee, no balance transfer fee, and a variable interest rate of 12.50-18.00% APR.2

Catch Up on More News

Explore News & Events for more updates on what's happening in your community and at the credit union.

1Must be 18 years or older to apply. Applicants under the age of 21 may require a co-signer unless independent means of repayment can be established. Introductory APR only applicable to new credit card applications. 1.99% Introductory APR for 6 months from issuance of the card on balance transfers and purchases. After the introductory period, APR will be adjusted based on creditworthiness and balance transfer fee will be at $30.00 or 3.00% of the amount of each balance transfer, whichever is greater. Rates are variable and subject to change and will be calculated based on the Wall Street Journal Prime Rate and may go up to a maximum of 18.00%. Minimum payment is 3% of total new balance or $35.00, whichever is greater. Cash advance fee is $10 or 3.00% of the amount of each cash advance, whichever is greater. Late and returned payment fee: up to $35. A Foreign Transaction fee of 2.00% will be applied in US Dollars to each transaction conducted outside of the United States. Additional limitations, terms and conditions may apply. Equal Opportunity Lender.

2Must be 18 years or older to apply. Applicants under the age of 21 may require a co-signer unless independent means of repayment can be established. APR based on creditworthiness. Rates are variable and subject to change and will be calculated based on the Wall Street Journal Prime Rate and may go up to a maximum of 18.00%. Minimum payment is 3% of total new balance or $35.00, whichever is greater. Cash advance fee is $10 or 3.00% of the amount of each cash advance, whichever is greater. Late and returned payment fee: up to $35. A Foreign Transaction fee of 2.00% will be applied in US Dollars to each transaction conducted outside of the United States. No balance transfer fees. Additional limitations, terms and conditions may apply. Equal Opportunity Lender.

Who We Are

As an active part of the community for 92 years, Neighborhood Credit Union is a not-for-profit financial organization serving the state of Texas with branch locations in Collin, Dallas, Denton, Ellis, and Tarrant counties. With assets topping $1 billion, Neighborhood Credit Union has a continuously growing membership of over 60,000. For more information, call (214) 748-9393 or visit our homepage.