Financial Literacy Resources

Explore Financial Literacy Resouces at Neighborhood Credit Union

GreenPath Financial Wellness

GreenPath Financial Wellness

With GreenPath, you have free access to money management and financial education services. GreenPath is a non-profit company that partners with you to achieve your financial goals.

With GreenPath Financial Wellness, you can receive assistance with:

- Personal and family budgeting

- Understanding your credit report and how to improve your score

- Money management

- Debt repayment

- Avoiding bankruptcy, foreclosure and repossession

Free Financial Literacy Webinars

We are in the business of helping people achieve their short and long-term financial goals for their families. Since we are passionate about our members' financial well-being, we frequently host free financial literacy webinars throughout the year that cover various topics for every stage of your financial journey! The workshops are open to the public and all ages are welcome.

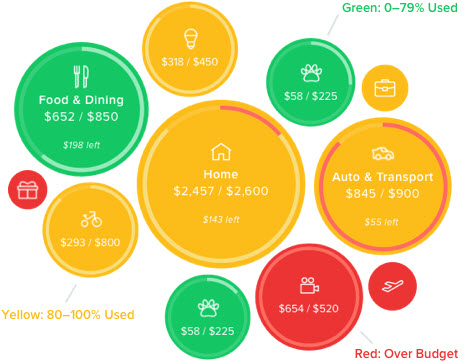

Money Management

Have a personal finance dashboard at your fingertips inside Online Banking and the MyNCU Mobile App. Access debt payoff calculators, track your financial goals and trends.

*Enrollment in Credit Score is optional. Credit information retrieved is considered a "soft pull" and does not affect your credit score. The credit score provided is intended to help you understand the factors that affect your credit score, and ways you may be able to save money. Data is not used for loan approval purposes or for determining loan rates with Neighborhood CU. Rates and approvals for loans are based on application and approval provided at the time of a loan application. The credit score found in the credit report may be different than the score displayed in Credit Score. Offers presented within Credit Score are not offers to lend nor are they guarantees of a rate you will receive. Terms, conditions, and offers are subject to change at anytime. Credit Score is powered by SaavyMoney (Privacy Policy) and reflects the VantageScore 3.0 from TransUnion.

Who We Are

As an active part of the community for 95 years, Neighborhood Credit Union is a not-for-profit financial organization serving the state of Texas with branch locations in Collin, Dallas, Denton, Ellis, Grayson, Kaufman and Tarrant counties. With assets topping $1 billion, Neighborhood Credit Union has a continuously growing membership of nearly 70,000. For more information, call (214) 748-9393 or visit our homepage.